Correlation Analysis - 1914 Gold Shortage

Correlation Analysis - 1914 Gold Shortage

|

Correlation Analysis. The official government reports, supplemented by newspaper accounts, enable a direct, monthly, U.S./France - export/import gold bar comparison, and, although less specific because of France's non-detailed monthly coin import data, a comparison between monthly U. S. gold coin exports and the monthly French - "Autres Pays" category - gold coin imports. The Correlation Tables are contained in the on-line data. (You can save and work with this data in MS Excel.) Separate yearly totals for U. S. bar and coin imports in the French "Tableau Général..." also permit 1904 through 1914 annual comparisons of:

As can be seen from the above chart, France consistently received more gold, combined bars and coin, than was reported as exported from the United States. These excesses were often significant, (such as France's receipt of close to $25,000,000 in U.S. gold coin in September of 1905, where there is no corresponding U. S. export report), but, more importantly, it can be seen that a consistent export-import pattern of French import overages exists in the combined bar and coin export-import comparisons. The "Secret" September, 1905, $22,000,000 U.S. Coin Export to France. Russia and Japan ended their hostilities, the Russo-Japanese war, by treaty on September 5, 1905. The in-excess of $22,000,000 in US gold coin that was received by France from the US in September, 1905, is most likely the result of the shifting of gold balances by Japan from New York, from the remaining proceeds of war loans that Japan had placed and raised on the New York market, to Paris. The Japanese loans were denominated in sterling, but at a fixed (4.87 dollars to the pound) rate of exchange to dollars, and the balance held in New York banks was reported by the Wall Street Journal, August 29, 1905, 8:1, as follows: Two results at least seem likely to follow adjournment sine die of the peace conference after signing a protocol declaring agreement impossible. The first result expected is that Japan would withdraw to Europe money now on deposit in New York and also the proceeds of the loan which was placed here last July, payment upon the bonds having been set for October 16 next. ... Persons with good opportunities for judging estimates of the amount of money now on deposit in New York to the credit of the Japanese government say it does not exceed $20,000,000 to $25,000,000. Normally, the settlement of international exchange would have required the shipment of gold bars, not coin. This excess is unusual in its composition: gold coin, currency corresponding to the proceeds of a converted-to-dollars "loan." It is very interesting to note that this export was NOT reported by the US Government. Such an amount of money – the equivalent of more than several billion in today's dollars - withdrawn from the New York market in 1905 would have had a significant negative effect. The planning to move this cash, too, would have required several weeks of advance coordination to both assemble and ship such a large sum. Money is seldom idle. Banks would use these funds; until Japan required these funds, the proceeds of the Japanese war loans were available to the New York banks to make short-term loans to other borrowers. The short-term loans that had been made would have to be recalled. This "constraint" would effect the New York money market. The US Government had the recent experience of moving $40 million in gold to Paris during April and May, 1904, for the purchase of the Panama Canal. The payment by the United States government for the Panama Canal property was the largest single international payment in the nation's history and one of the largest payments ever made within so short a space of time. The Panama Canal Payment, Maurice L. Muhleman, The Journal of Political Economy, Volume 12, Issue 4 (Sept. 1904, 473-494). Even then, only $6,250,000 in coin was shipped; the in-excess of $30 million balance was in the form of gold bars. But, of course, the payment for the Panama Canal was expected by the public, and was adjusted within the market. The Government's planning for the physical transfer of funds for the Panama Canal payment began in February, a full two months before the funds were shipped. The Government's concern for the effects of so large a payment is obvious; Treasury Secretary Shaw was instrumental in coordinating the transfer of funds for the Panama Canal purchase, as was J. P. Morgan. The September, 1905, shipment of another extremely large amount of gold, but entirely in the form of gold coin - NO gold bars, may have been in that form specifically to aid in the secrecy of the shipment. Describing the export of gold in 1909, and reporting requirements, the Wall Street Journal stated: ... If gold is exported under present conditions, it will not appear in the report of the transactions of the banks with the Sub-Treasury, because the Assay Office has no bars available for export [which would appear in Assay Office export records], and exports of coin do not appear in the Sub-Treasury operations. [Emphasis supplied.] Gold coin is obtainable in payment of gold certificates and the transactions are not reported in Sub-Treasury operations any more than would be the exchange of any form of currency for another. ... Wall Street Journal, January 21, 09, 8:1 For these reasons, the 1905 $22 million shipment could not have been exported without the US Government's knowledge, consent and participation. And yet, the Wall Street Journal, September 2, 1905, 8:2, reported the comments of Secretary of the Treasury Shaw, a person who would have certainly been involved in authorizing and - as he had done in the Panama Canal payment transaction - organizing such a shipment. The Wall Street Journal entitled the article: SECRETARY SHAW ON GOVT. FINANCES, Unusual Demand [Emphasis supplied.] for Money for Crops – No Indication of Any Stringency. The article coninued: "Government finances are in good shape," says Secretary of the Treasury Shaw. "Customs receipts are keeping up, and for the current fiscal year are nearly six millions ahead of what they were for the same period last year. There is also an increase of $1,500,000 in internal receipts. The "money to the interior to pay for crops" cover story had been placed. A sampling of relevant newspaper articles, excerpts and our notes for future study/research of/on this secret shipment can be acquired here. There are numerous clues in the reported actions of the banks (recalling short term loans), the money market (increasing rates for short term loans), commentary on the discrepancies in bank and Government currency statements, discussions concerning the financial consequences of the outcome of the Russo-Japanese peace, to provide both the motivation and method for this "secret" shipment. A more thorough analysis is outside the scope of our Republic research. Suffice it to say that, given the political necessity, to maintain market stability, the government can intervene.

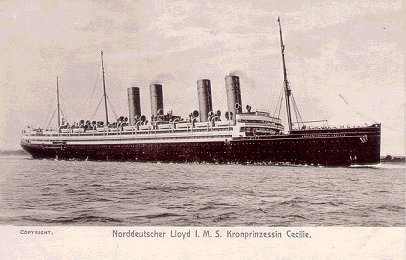

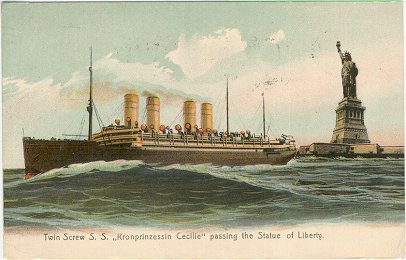

North German Lloyd Liner IMS Gold Bar Correlation - 1914 Shortage. The yearly comparison of gold bar exports vs. gold bar imports also exhibits a consistent pattern of overages, with one exception. A shortage occurs in 1914. An examination of the 1914 Correlation Table indicates a bar shortage as follows:

Twin Screw S.S. Kronprinzessin Cecilie From the data it appears that the July 23rd engagement arrived, but that the July 27th and 28th did not. Further research indicates:

Journal of Commerce, August 3, 14, 3:6 According to this report, the Kronprinzessin Cecilie carried the July 27th ($4,764,333 total) engagement, and the La Savoie carried the July 28th $2,045,146 engagement. Additional investigation provides: SHIPPING IN DANGER FROM HOSTILE ACTS Transportation in Foreign Trade Seriously Damaged by GERMAN VESSELS ORDERED NOT Fear That Other Vessels May Be Subject to Attack Journal of Commerce, August 1, 14, 1:4 GERMAN TROOPS ENTER FRENCH TERRITORY, Journal of Commerce, August 3, 14, 1 |

|||||||||||||||||||||||||||||||||||||